Australian Legal Trust Accounting Software Is Easy to Use and Built Exclusively for Law Firms

Legal Trust accounts are simple forms of booking used exclusively to hold funds in trust and manage the transactions to and from that trust account. Trust accounts are recorded by a trustee of the receipt and payment of other people’s money into individual trust ledger accounts maintained for the person from or on whose behalf the trust account was created.

Save Time with Trust Accounting Tools Developed for Law Firms

“NebuLAW simplified a very time-consuming part of our practice”

- Easy to follow workflows

- Intuitive design

- Auditable data trails

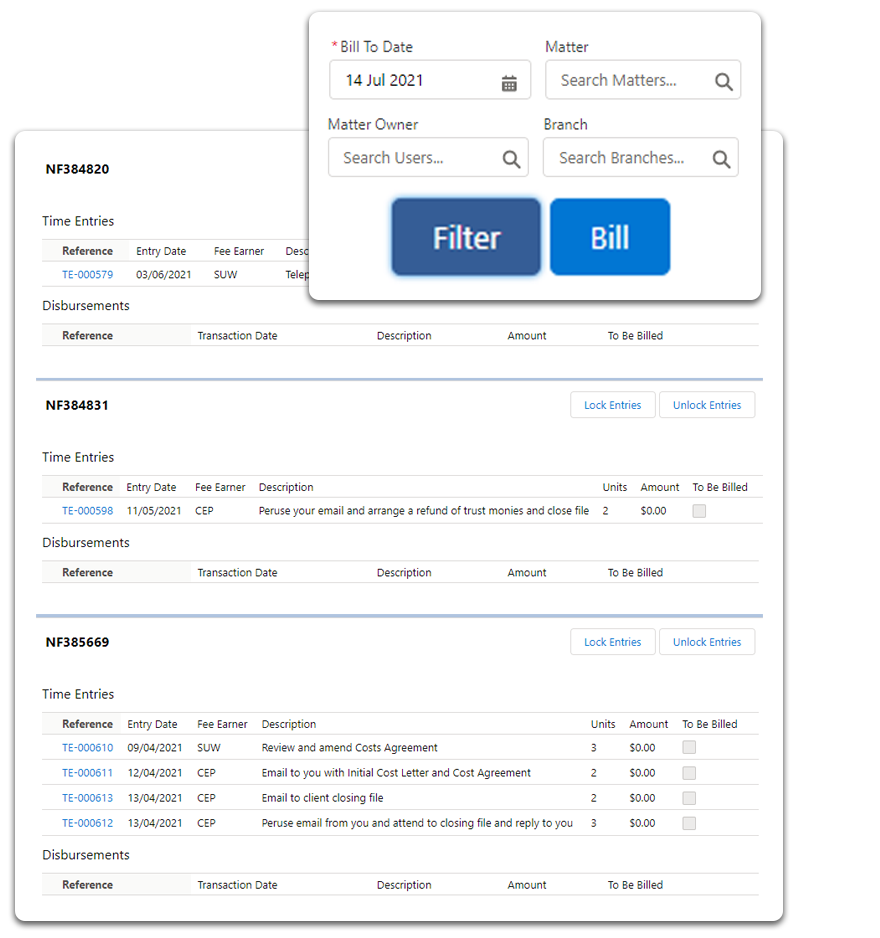

- Bulk billing, invoicing and receipting

- Invoice 500 matters as quickly as you invoice 1 file

Be Confident in Your Ability to Manage Your Trust Account

At the core of NebuLAW’s trust accounting system is a full audit trail; every change, every transaction is fully documented and recorded. Our system is currently in use in all major Australian Jurisdictions and compliant with all their trust accounting criteria.

Traditionally keeping your trust safe and secure involves good business practices in the firm, understanding cyber security risks, selecting ethical and honest employees and close oversite by management. NebuLAW simplifies this process, removes many of the traditional risks and overheads involved in on-premise trust software simplifying the entire process.

Always Know Your File Balances

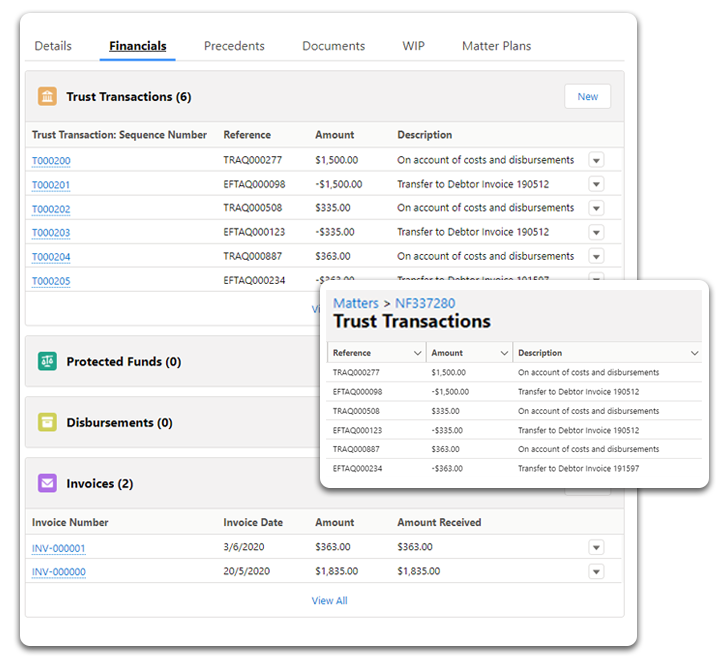

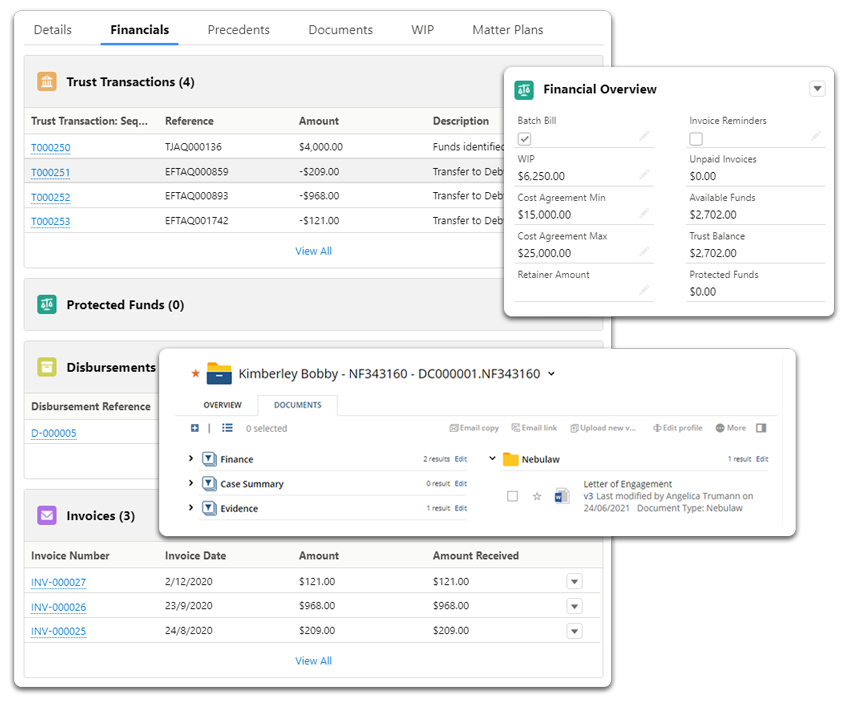

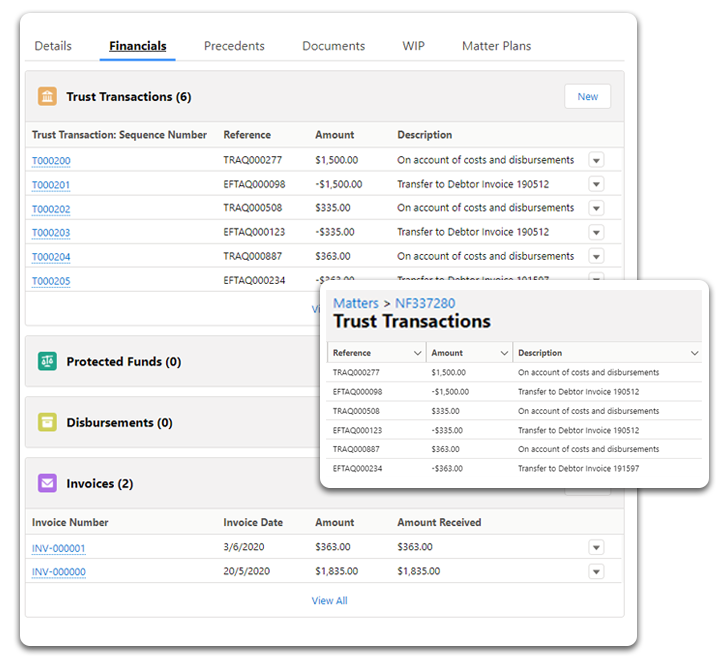

Having a built-in trust accounting system allows clear visibility for everyone working on a file of what has been billed, current balances and projected costs.

- Always know your client balances

- Always work for funds in trust – no negative file balances!

- Lower your firm’s bad debt

- Manage invoice adjustment requests from the matter

- Communicate directly with accounting on the matter or invoice level

Trust Transactions

NebuLAW simplifies the entire trust transaction process, it supports all types of trust transactions while every receipt, invoice, cancellation and deposit listing is automatically documented and recorded.

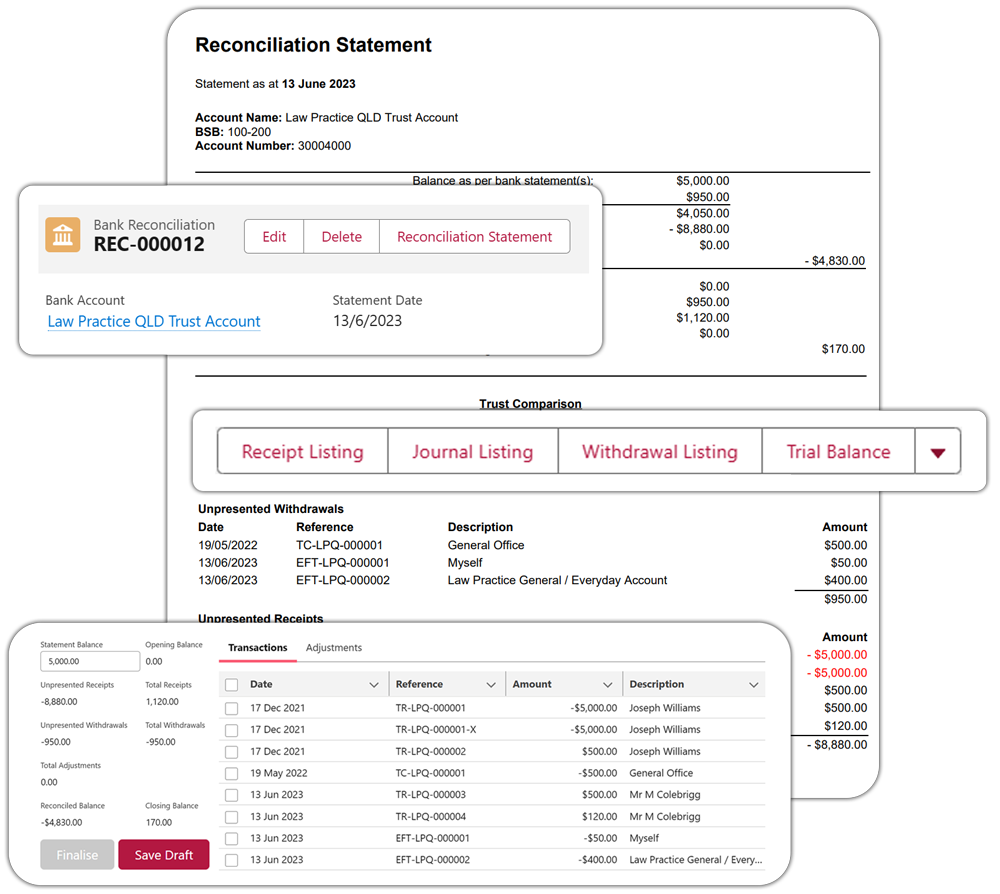

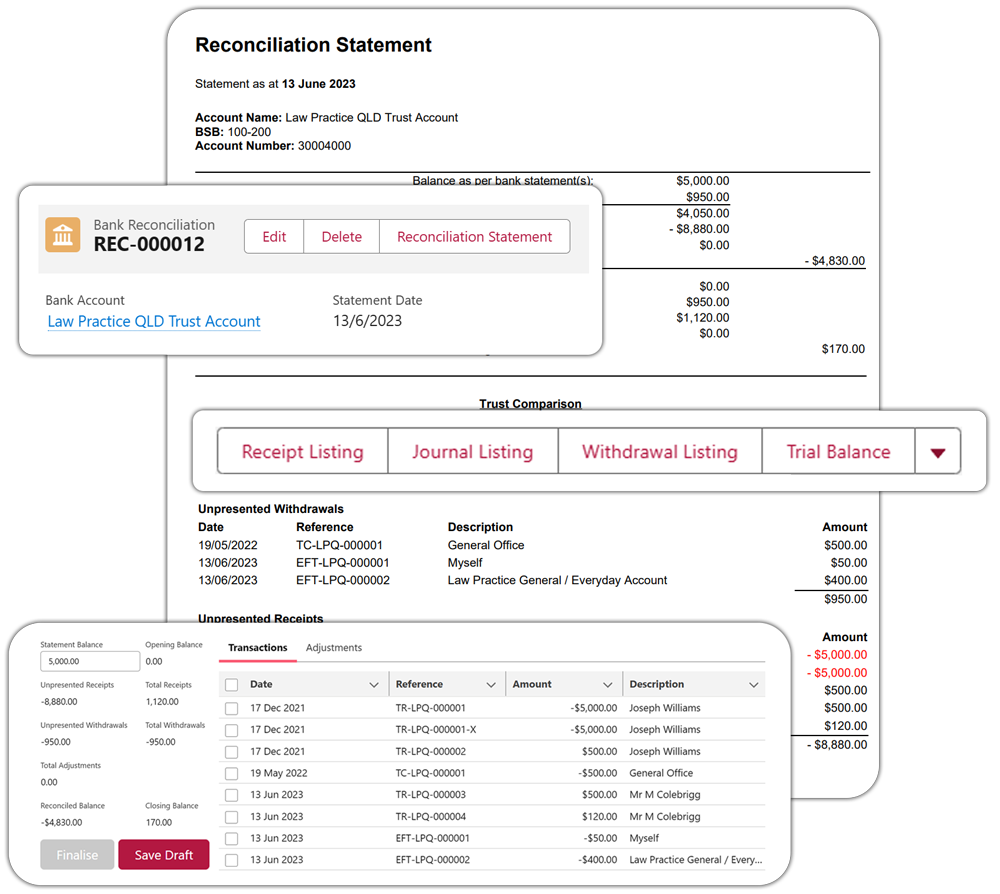

Reconciliation of Trust Accounts

Using NebuLAWs, trust reconciliation is easy.

- Invoice payments and receipts are all automatically available for reconciliation.

- Easily track down any discrepancies

- The simple end-of-term reconciliation process

Statutory Deposits

If required by your law society are easily managed within NebuLAW

Trust Reports

Everything in NebuLAW is tracked and can be reported on, easily produce critical trust reports such as:

- Trust Journals

- Reconsciliation reports.

- Trust Ledgers

- Trust Audit

- Trust Balance

- Overdrawn Trust Balances

Three-Way Reconciliation Report

What is this report? A three-way reconciliation between your bank balances, trust ledgers and your client matter balances.

Why is it important? For trust accounts, this is the mother of all reconciliation reports. International bar associations require this audit to be completed periodically. This report can help pick up on any inconsistencies or issues in your business process before they get out of hand as mistakes will be highlighted in each of your three financial pillars.

Tips and Tricks: Don’t assume your general accounting software (QuickBooks etc) will do these reconciliations for you. Generally, most platforms will only complete a 2-way reconciliation.

Detailed Reconciliation Report

What is this report? This report provides the supporting detail between your bank accounts and trust account ledgers, showing all your cleared items from the trust (i.e., transactions that showed up on your bank statement) as well as the uncleared or outstanding items from your trust ledger (i.e., transactions that were processed but have yet to show up on a bank statement).

Why is it important? When maintaining your trust ledger, you need to periodically compare your internal accounting records, or trust ledger, to your bank statement. This gives you the confidence that your internal accounting records are complete and accurate this is a foundational element of any reliable accounting process.

Tips and Tricks: Do this report immediately after month-end accounting so you can get on top of any inconsistencies quickly.

Trust Ledger Report

What is this report? A high-level report that that doesn’t separate out each transaction by the client. Also referred to as a check register, general ledger, statement of costs and receipts, etc., tracks all the transactions into and out of your trust account(s).

Why is it important? This is your key report to provide a summary and reconcile your trust and general accounts.

Tips and Tricks: If you ever need to resolve an issue within your trust accounting, this report will likely be used to take action, and, by ensuring you’ve captured all the right data for each transaction, you can make changes quickly and efficiently. In the real world, mistakes will be made, so it’s best to have a clear and easy way to correct them.

Client Activity Report

What is this report? This report lists every client or matter, their balance at the beginning of the month (or reporting period) all activity on their account and calculates their end of month balance.

Why is it important? This report is an extremely valuable addition to your month-end review. A quick and easily consumable snapshot giving inside into activity on a client by client basis. that gives insight into account activity on a client-by-client basis, making t

Tips and Tricks: Use this report to identify high-level issues, such as irregular activity, clients’ with negative balances, or missing transactions.

Payments Report

What is this report? Summary of all transactions that have left your Trust accounts for the reporting period

Why is it important? This report can be used as a great tool to check for fraud by scanning all payments and comparing them to your bank statement. In addition, you can also use this report to check your accounting processes. If you start to see a lot of voided checks, irregularities in check information, etc., this report will highlight those areas and prompt you to perform follow up procedures.

Tips and Tricks: Take a sample of checks that have cleared your bank during the month (start with the bank, not your payments report) and compare the information on the checks to your payments report. Look for discrepancies or irregularities in the following fields: check number, payee, payee address, amount, signature line, and endorsement.

Deposits Report

What is this report? This report provides a breakdown of each deposit made during the month.

Why is it important? Deposits on your bank statement typically show up as one lump sum—there’s no breakdown of the actual checks or credit card transactions. With this report, you’ll have that breakdown.

Tips and Tricks: During reconciliation use this report as a shortcut to confirm the deposits made into your bank accounts against your internal accounting records.

See How We Simplify Law Firm Accounting!

See how our built-in trust accounting suite stacks up against the costly competition!